Haslam Advances Browns Stadium Plans After Land Purchase in Brook Park

by Ken Prendergast, NEOTrans | Nov. 22, 2024 | 5:00 PM

Ken Prendergast, NEOTrans

A small but strategic piece of land that was in the way of the Haslam Sports Group’s (HSG) proposed stadium for its Cleveland Browns football team in suburban Brook Park has sold. Its sale gets it out of the way and into the fold of the overall property transaction for the roofed stadium. And in neighboring Berea, where HSG and its partners plan a Browns-themed mixed-use development, site plans are getting their first airing tonight as part of a rezoning request.

In May, NEOtrans reported that an integral piece of land was blocking the stadium development. The news came shortly after we broke the story that Haslam had a purchase agreement with a partnership led by Scannell Properties of Indianapolis to acquire 175 acres of a former Ford auto plant in Brook Park.

At the time, a spokesperson for the property owner, electric utility FirstEnergy Corp., told NEOtrans it had not entered into any agreements for the sale of the 3.68-acre property that blocked the stadium. Whether that was true or not then, the status of that property has certainly changed now.

Jennifer Young, manager of corporate communications at Akron-based FirstEnergy, said the 3.68-acre, two-parcel property sold Nov. 15 to the partnership that has the sale agreement with a Haslam affiliate named Primacy Development LLC. The partnership, DROF BP I LLC, paid $144,000 for the land, she said. DROF is “Ford” backwards and BP refers to Brook Park.

A source familiar with the transaction confirmed that the potential property acquisition was referenced in the purchase agreement initiated in March between Primacy Development and the Scannell-led partnership. A memorandum, or summary, of that agreement is available in public records, kept by the Cuyahoga County Fiscal Officer.

But it didn’t reveal all of the agreement’s details. The full agreement is not a public record. The memorandum of the purchase agreement was silent on the fate of the FirstEnergy utility right of way. It did say that the agreement remains in effect until for another 13 months until Dec. 31, 2025. If the sale doesn’t close and the deed doesn’t transfer by then, the purchase agreement will lapse.

Another public document, a security agreement filed with the county, shows a promissory note due in the amount of $18.75 million, payable by Primacy. It suggests that amount is Primacy’s agreed-upon purchase price for the Brook Park land. Including the utility right of way, that brings the stadium development site to a total just shy of 179 acres.

Peter John-Baptiste, vice president of communications at the Browns and for HSG, declined to comment.

The property-owning partnership also includes Weston Property Group of Warrensville Heights and the DiGeronimo Companies of Independence. The partnership envisioned the site, branded as the Forward Innovation Center-West, as accommodating industrial, warehousing or other commercial uses. NEOtrans reached out to a Weston sales agent listed with the property for comment but hasn’t gotten a response yet.

Despite the utility right of way being a narrow piece of land, only about 100 feet wide, it extends roughly 1,400 feet deep into the very center of the proposed stadium site and blocks a large-scale development like what HSG has planned. On that land currently are pairs of side-by-side towers carrying high-tension, high-voltage power lines. They would have to be relocated to make way for a stadium.

Those wires deliver electricity to Ford Motor Company’s nearby Engine Plant No. 1, 5600 Henry Ford Blvd. That 1.6-million-square-foot plant remains active and employs about 1,834 workers. Two other Ford plants were razed in recent years and their land is proposed to be redeveloped by Primacy for a $2.4 billion stadium and $1.2 billion of supportive, mixed-use development.

“The company (FirstEnergy) reserved all rights to maintain and operate the existing electric utility infrastructure on the parcels,” Young told NEOtrans. That will continue until the utility infrastructure is relocated.

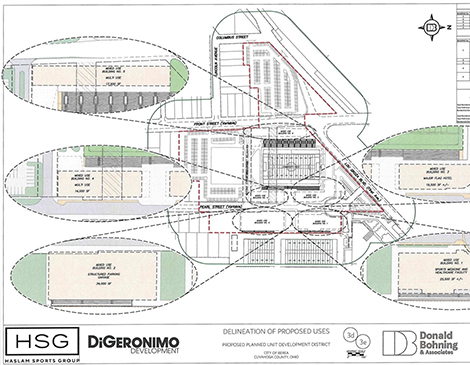

Meanwhile, the public will get its first look tonight at conceptual site plans for a 500,000-square-foot mixed-use development called District 46, to be located next to the Browns’ CountryCountry Mortgage Campus, 76 Lou Groza Blvd. Previously, only several renderings were shown. But the potential location of buildings and streets or development phasing was not clear until now.

At a meeting of the Berea Planning Commission, principals involved in the proposed $221 million development will start a three-step process of requesting a rezoning for the project. While the type of rezoning being requested represents a greater commitment to the project, it also gives the developer district-wide flexibility in land use design versus a city’s existing lot-by-lot zoning.

Berea Mixed Use Project LLC, an affiliate of DiGeronimo Companies, is requesting a Planned Unit Development (PUD) zoning overlay on 16 acres of land owned by HSG in the vicinity of Front Street and Lou Groza Boulevard. A PUD zoning is tied specifically to the site plan for the development — including buildings, streets, sewers, green spaces and even special building materials — so if any part of the plan is changed, the whole thing has to be rezoned.

Tonight, planning commission members will determine if the project’s conceptual design meets all city codes. If so, a more detailed PUD plan will be presented at a public public hearing where the commission may make a recommendation for passage to Berea City Council. If council approves it, the PUD plan carries the force of law.

The name of the new development, District 46, refers to the year 1946 when the Browns professional football franchise was founded. A $150 million first phase could see construction start before April 2025.

The conceptual plan shows six structures surrounding a community athletic field with seating for up to 7,000 spectators. Five structures are included in the first phase, including a three-level, roughly 200-space parking garage between Pearl Street and the Browns’ existing practice fields.

North of the garage and next to a new traffic circle on Pearl would be a three-story, 45,000-square-foot sports medicine and healthcare facility operated by University Hospitals Health System (UH). It will also have ground-floor mixed uses, according to site plans and other public records first shared by NEOtrans last week.

The UH building will have a 10,500-square-foot sports medicine facility, 20,000 square feet of office space, 3,500 square feet of restaurant space, a 3,500-square-foot retail space, and a 7,500-square-foot media/entertainment studio.

On the other side of the new traffic circle on Pearl from UH’s facility, overlooking the new community field, will be a five-story major flag hotel with 136 rooms. The hotel, whose brand was not released publicly, is proposed to measure about 96,365 square feet. The same development team here is also building a 136-room AC Hotel by Marriott at Valor Acres in Brecksville.

Bracketing the new athletic field will be two 75-unit apartment buildings with a 5,000-square-foot restaurant on the ground floor of each. But the larger building will also have ground-level parking behind what appears to be a featureless façade along the sidewalk on Front.

The site plan also divulges the proposed uses of a large, potentially three-story building, south of the community field. Part of a second phase, the building would house a new community recreation center and possibly some commercial space.

Last spring, HSG and Berea officials unsuccessfully sought $15 million in state capital budget funds for the mixed-use development — $5 million for the recreation center and $10 million for a multi-purpose sports fieldhouse. Those community uses may have to wait until another source of public funding is found or the city takes another shot at the capital budget in 2026.

For the first phase, the developers are seeking $2 million worth of Transformational Mixed Use Development tax credits from the Ohio Department of Development. Berea Mayor Cyril Kleem said the city is also finalizing terms of a Tax Increment Financing (TIF) package with the District 46 development team.

A TIF captures new tax revenues to be generated by a development in a specific district for use in servicing debt raised to pay for infrastructure and other associated development costs. Revenues proposed for the District 46 TIF are new payroll taxes, event admissions taxes and hotel bed taxes from the development, he said. Other revenues the city will receive are four annual payments in lieu of taxes totaling $4 million starting in 2026.

For more updates about Cleveland, sign up for our Cleveland Magazine Daily newsletter, delivered to your inbox six times a week.

Cleveland Magazine is also available in print, publishing 12 times a year with immersive features, helpful guides and beautiful photography and design.

Ken Prendergast, NEOTrans

Ken Prendergast is a local professional journalist who loves and cares about Cleveland, its history and its development. He has worked as a journalist for more than three decades for publications such as NEOtrans, Sun Newspapers, Ohio Passenger Rail News, Passenger Transport, and others. He also provided consulting services to transportation agencies, real estate firms, port authorities and nonprofit organizations. He runs NEOtrans Blog covers the Greater Cleveland region’s economic, development, real estate, construction and transportation news since 2011. His content is published on Cleveland Magazine as part of an exclusive sharing agreement.

Trending

-

1

-

2

-

3

-

4

-

5